Esg Investing Fundamentals Explained

Simply put, is it that better companies have the versatility to concentrate on ESG topics, or is the concentrate on ESG enhancing their value? Can you comment on that, Sara? Sign up for the Within the Strategy Room podcast I assume that is among the defects of the study now.

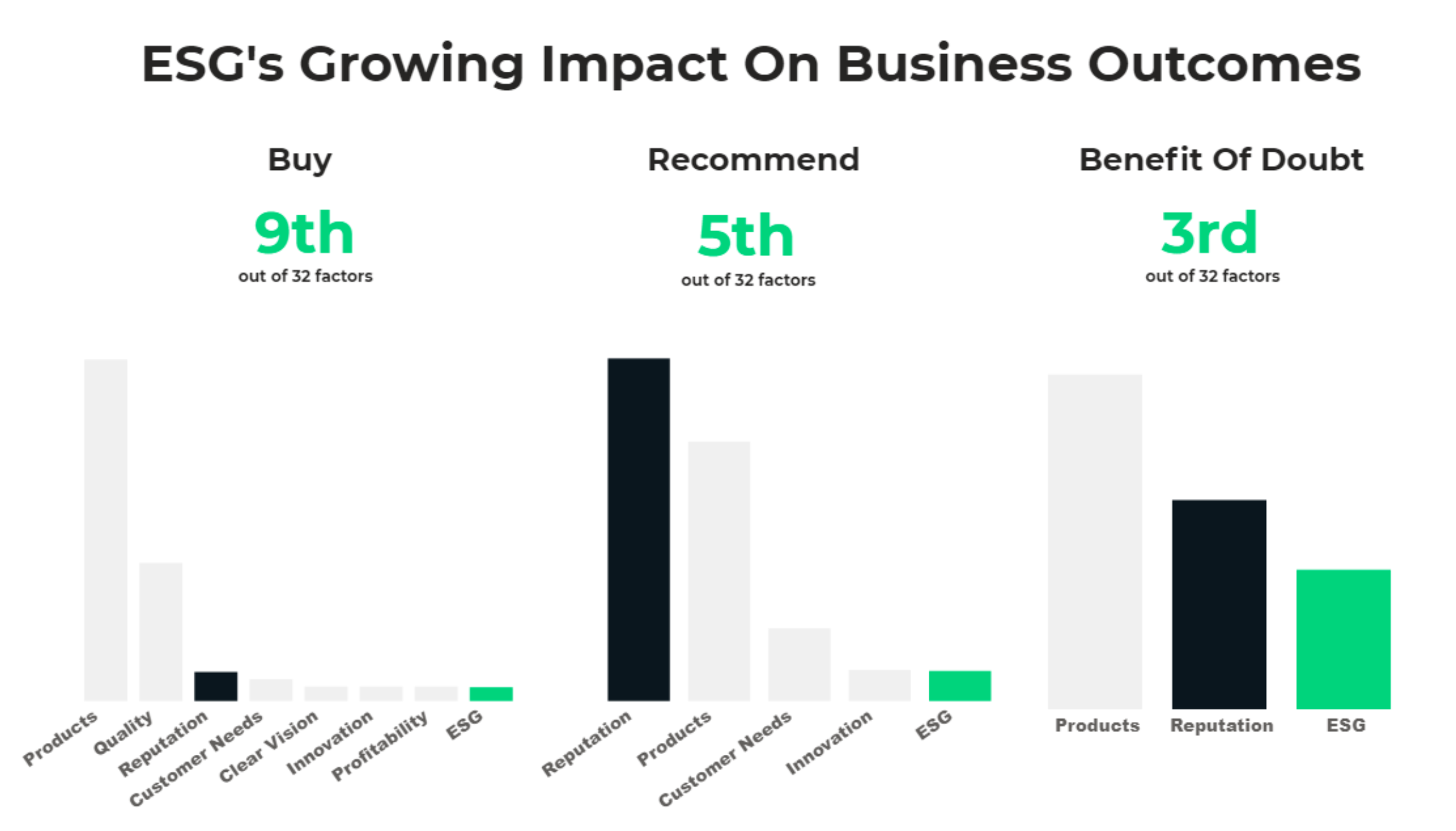

That said, I serve a great deal of the financier customers as well as they claim that indeed, we could invest a great deal of additional time looking into whether there is a relationship or actual origin, but in practice, given they do not yet have that information, they wrap up that there is a web link and spend with that in mind.

What is your experience of exactly how ESG is determined and also what do you see as difficulties? We lately did research study to understand the landscape of sustainability coverage and several fascinating conclusions appeared of that. Of all, it is indeed an area with a lot of details.

Some Known Details About Esg Investing

The stakeholders have a tough time making sense of all that reported information. A recent survey highlighted that while 90 percent of firms report on sustainability, just 15 percent of investors can efficiently incorporate this information right into their financial investment choices. Is that difference caused by an absence of standardization? That is one part of it.

Many select numerous, so you wind up with a lot of data as well as, in many cases, limited openness regarding just how that data associates with the company's financial performance. We make every effort to supply individuals with specials needs equal access to our site. If you would certainly like details concerning this web content we will certainly be pleased to deal with you.

A metric like work environment diversity or water usage can be defined in different ways depending upon the standard you select to adopt. There is no validation or bookkeeping of this data, so as a stakeholder you can't be totally comfy with its high quality. If we contrast this to monetary reporting, for instance, we need to go back around 100 years to locate the exact same level of maturity.

There are also numerous campaigns to consolidate reporting as well as information. Should executives be thinking about ESG factors throughout diligence, postdiligence, assimilation? As an acquirer you need to evaluate the quality of a property and also ESG is essential to that.

The Basic Principles Of Esg Investing

Are you acquiring into a possession that may be dealing with right into a governing headwind because it's not managing its carbon impact responsibly? On the other hand, are you acquiring right into a property that is well-positioned to expand given the consumer trends and can anticipate good growths in ESG terms of talent as well as expenses? These components are necessary to review as component of the diligence similarly you review the target's market placement and client base.

You can then develop that right into your integration planning in choosing which initiatives to increase in the obtained firm or where to enhance ESG attention as well as mitigate the threats. There is no bookkeeping of ESG data, so as a stakeholder you can't be completely comfortable with its high quality. If we contrast this to economic coverage, we require to return 100 years to find the same level of maturity (ESG Investing).

The initial one is to locate out the variables that are really material in the asset or industry you are looking into. Our study discovered that if you put all these requirements and also frameworks with each other, there are around 40 different ESG areas. When you then look at those through the lens of what is usually worldly, suggesting what remains in the public eye, we can tighten them down to around nine various ESG variables.

3 Easy Facts About Esg Investing Explained

It might change namesit was called corporate social obligation prior to, and also it's connected with the increase of focus on business function. Yet the basic topic of the firm's license to operate is here to stay.

Well now, that is the inquiry of the millenia. You might state it is since it helps business be extra sustainable and less likely to fail. You might say it is because it helps to guarantee that business are placing their cash into the appropriate points. You can claim it is due to the fact that investing only in what you intend to see more of on the planet is good for everyone.

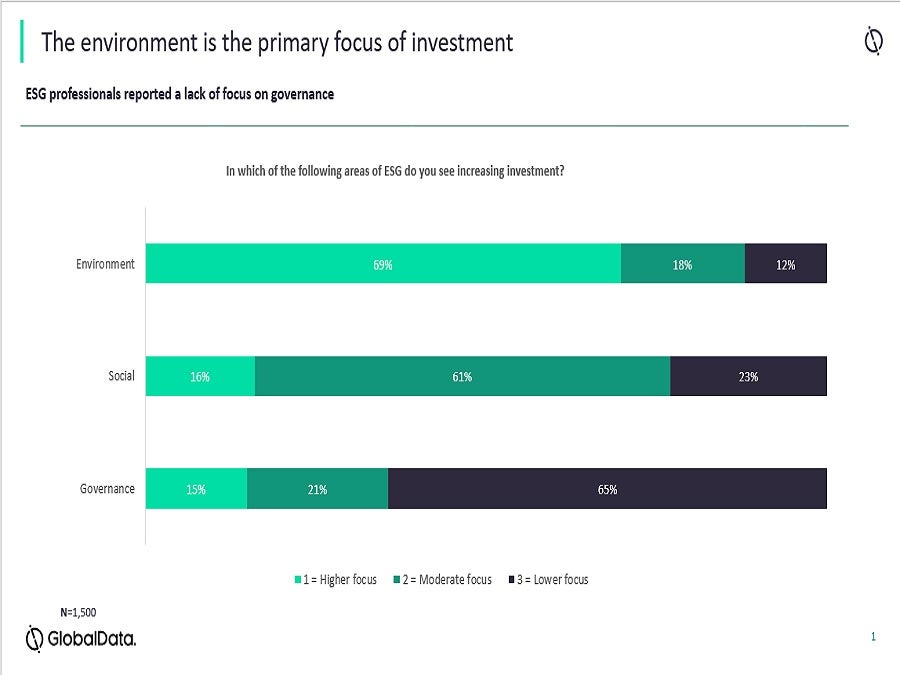

I am going to damage ESG down for you in simple terms, so you can really see what it has to do with. To answer this inquiry I believe it is essential to look at what ESG stands for. ESG is a phrase for Environmental, Social and also Administration. The objective of the motion is to guarantee that companies take right into account not just their profit margin yet additionally the influence they carry the world and also culture as whole.

Comments on “Some Known Facts About Esg Strategy.”